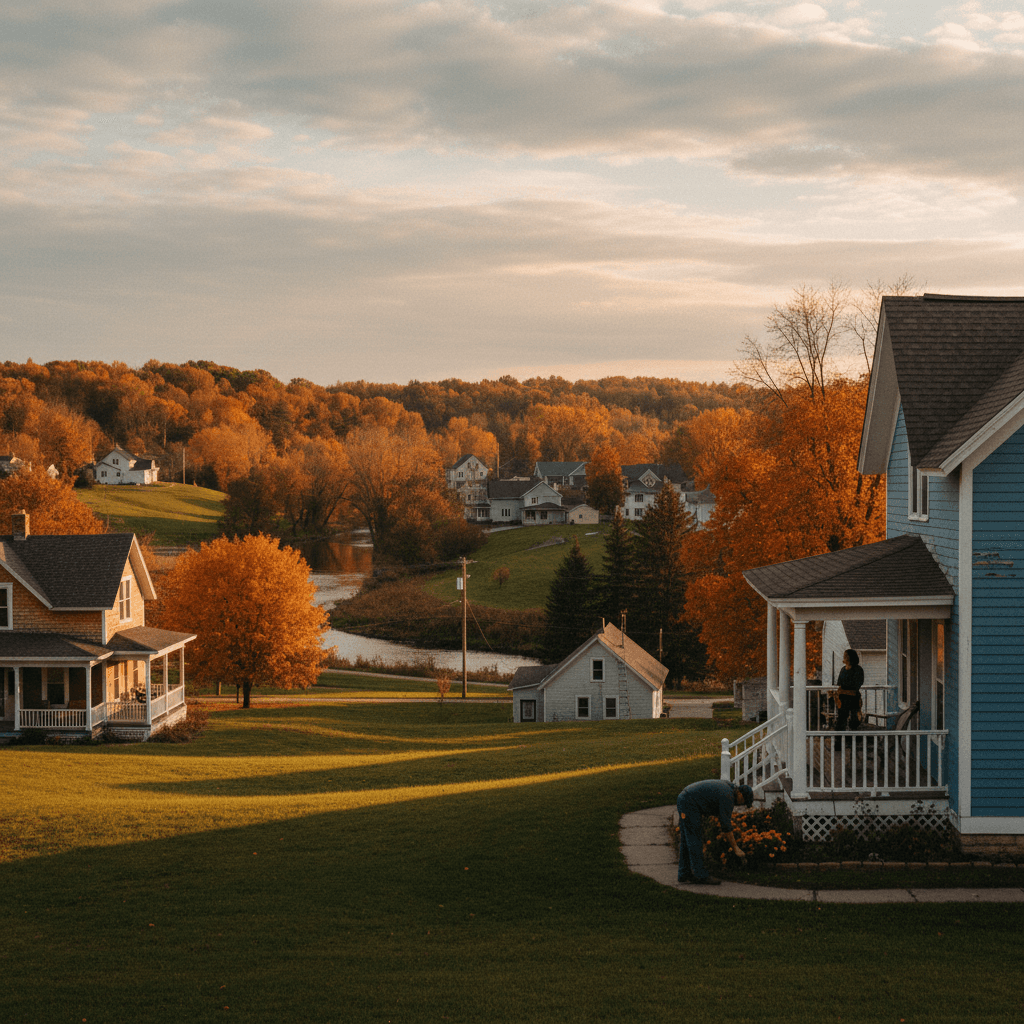

Welcome to the exciting world of homeownership in Hillsboro, North Dakota! Buying a home is a monumental step, and while the joy of having your own space in our tight-knit community is immense, it also ushers in a new set of financial responsibilities. As your trusted guide, I’m here to help you navigate these waters with confidence. Understanding how to manage your home’s finances effectively from day one is key to a secure and happy future in Hillsboro.

Mastering Your Home Budget in Hillsboro

One of the most crucial steps for any new homeowner is establishing a comprehensive budget. Beyond your mortgage payment, several other costs contribute to the true expense of owning a home in Hillsboro. Being prepared for these will save you stress down the road.

Understanding Your Monthly Costs

Your mortgage payment is often just the beginning. Most homeowners pay what’s known as PITI: Principal, Interest, Taxes, and Insurance. Make sure you understand how each component contributes to your monthly outlay. Beyond PITI, factor in utilities. North Dakota winters mean higher heating bills, while summer months might see increased cooling costs. Budgeting for these seasonal fluctuations is essential. Also, consider if your property has any Homeowners Association (HOA) fees, although these are less common for single-family homes in our area.

Setting Aside for the Unexpected

Homes, like anything else, require care and can surprise you with unexpected issues. A burst pipe, a malfunctioning furnace, or a leaky roof can quickly drain your savings if you’re not prepared. Aim to build an emergency fund specifically for home repairs and maintenance. A good rule of thumb is to save 1-3% of your home's value annually for these costs. This proactive approach ensures you're ready for anything, from minor fixes to larger, unforeseen expenses.

Navigating Property Taxes and Insurance

Understanding local property taxes and securing the right insurance are vital for protecting your investment in Hillsboro.

Hillsboro Property Taxes Explained

Property taxes in Hillsboro, like the rest of Traill County, contribute to our local schools, infrastructure, and public services. These taxes are based on your home’s assessed value. It’s important to understand how your property is assessed and what your annual tax obligations are. Most mortgage lenders will collect property taxes as part of your monthly escrow payment, but it’s still wise to review your tax statement annually to ensure accuracy and plan for any potential changes.

Protecting Your Investment with the Right Insurance

Homeowner’s insurance is non-negotiable and often a requirement of your mortgage lender. It protects your home and belongings against perils like fire, theft, and certain natural disasters. Given our regional weather patterns, it’s also crucial to understand what your standard policy covers and if you need additional coverage, such as flood insurance, especially if your property is near the Goose River, or specific coverage for severe weather events common to North Dakota.

Smart Savings for Long-Term Homeownership

Beyond immediate financial planning, thinking long-term about your home’s financial health will serve you well.

Proactive Home Maintenance Fund

Regular maintenance is not just about keeping your home looking good; it's a smart financial strategy. Budgeting for routine tasks like furnace inspections, gutter cleaning, roof checks, and general upkeep can prevent small issues from becoming costly repairs. For instance, ensuring your heating system is efficient is especially important for managing energy costs during our cold Hillsboro winters. A little preventive care goes a long way in preserving your home's value and saving you money over time.

Building Equity and Future Planning

As you make mortgage payments, you're not just paying down a loan; you're building equity in your home. Equity is the portion of your home that you truly own. Over time, as your home appreciates in value and your mortgage balance decreases, your equity grows. This equity can be a powerful financial asset for future goals, whether it’s for renovations, your children’s education, or even a future move. Keep an eye on your home's value and consider accelerating mortgage payments if your budget allows, to build equity faster.

Becoming a homeowner in Hillsboro is a rewarding journey, and with a solid understanding of your financial responsibilities, you can truly enjoy every moment. By mastering your budget, understanding property taxes and insurance, and planning for long-term maintenance and equity growth, you’re setting yourself up for financial success and a fulfilling life in your new home. Welcome to the neighborhood!

Frequently Asked Questions

What are the typical hidden costs of homeownership in Hillsboro, ND?

Beyond your mortgage, common hidden costs include higher utility bills due to North Dakota's climate (especially heating in winter), property taxes, homeowner's insurance, and ongoing maintenance. It's wise to budget an emergency fund for unexpected repairs like furnace issues or roof leaks, which can arise in any home.

How can I prepare for Hillsboro's property taxes and insurance needs?

For property taxes, understand your home's assessed value and factor the annual amount into your budget (often collected via mortgage escrow). For insurance, secure a comprehensive homeowner's policy that covers common risks in our region, such as severe weather. Consider additional coverage like flood insurance if your property is near the Goose River or in a flood-prone area.

What's the best way to save for home maintenance in Hillsboro?

A good strategy is to set aside 1-3% of your home's value annually into a dedicated maintenance fund. This covers routine upkeep like HVAC servicing, gutter cleaning, and lawn care, as well as larger, unforeseen repairs. Proactive maintenance helps prevent minor issues from becoming costly problems, especially important for managing your home through Hillsboro's distinct seasons.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.