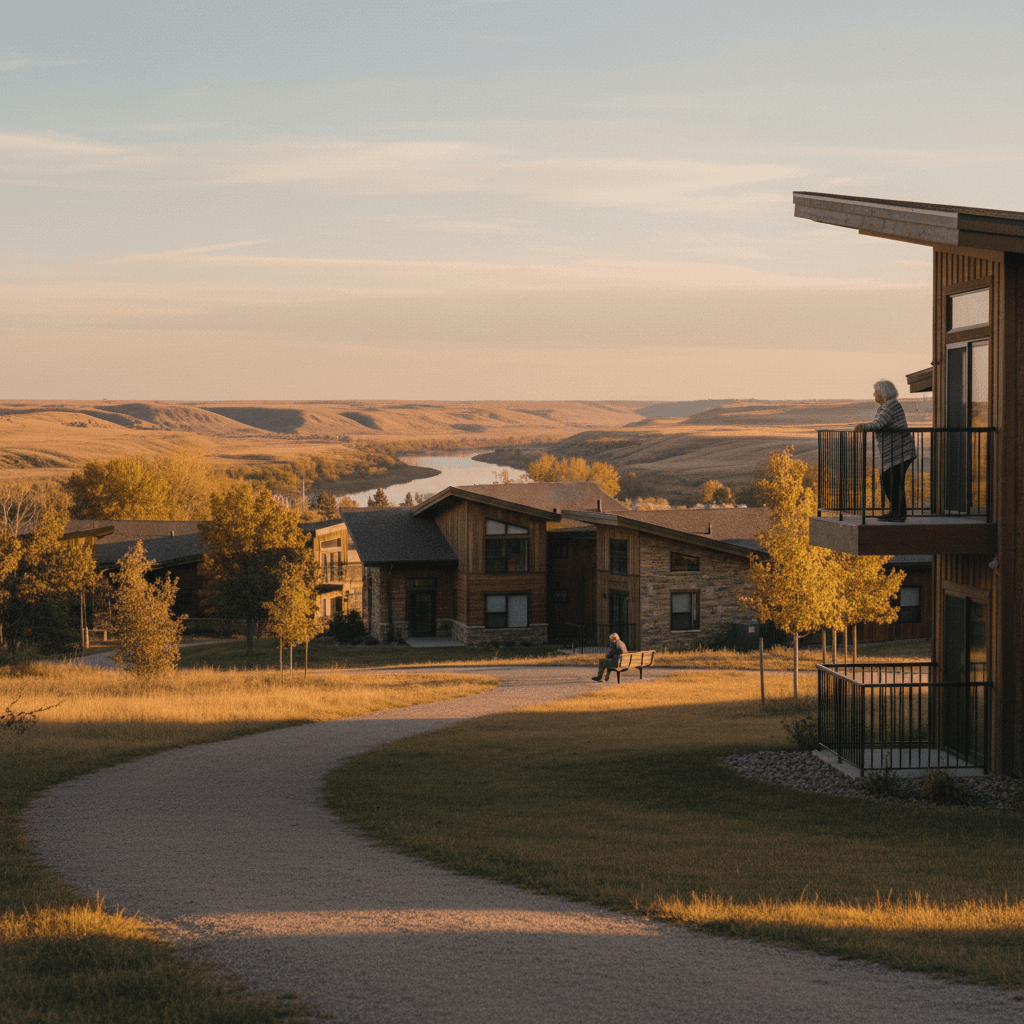

Vergas, Minnesota, with its charming small-town atmosphere and proximity to beautiful lakes like Lake Lida and Little Pelican Lake, offers a unique appeal for prospective homeowners. Whether you're drawn to the tranquil lake life or the close-knit community spirit, understanding the local lending landscape is a critical first step. Navigating current mortgage rates and local financial news specific to Vergas can significantly impact your home-buying journey, ensuring you make informed decisions in this appealing Minnesota locale.

Current Mortgage Trends and Their Impact in Vergas

The national mortgage market inevitably influences local conditions, but Vergas, MN, possesses its own nuances that prospective buyers should consider. Current interest rates, while set by broader economic factors, can manifest differently in a smaller, community-focused market. Understanding these trends is essential for anyone looking to secure financing for a home in Vergas, whether it's a cozy cabin or a family residence.

Understanding Local Rate Influences and Loan Options

While national headlines often focus on the Federal Reserve's actions, local factors such as housing inventory, regional economic stability, and the presence of community lenders play a significant role. For instance, the demand for lakefront properties around Lake Lida can influence appraisal values and, subsequently, the loan-to-value ratios offered by lenders. Buyers in Vergas have access to various loan options, including conventional, FHA, VA, and USDA loans, the latter being particularly relevant for qualifying rural areas. Each option comes with specific requirements and benefits, making it crucial to assess which best fits your financial situation and the type of property you're purchasing in Vergas.

Navigating the Mortgage Application Process in a Small Market

The mortgage application process, while standardized, often benefits from local expertise. In a community like Vergas, lenders often have a deeper understanding of local property values, market dynamics, and even specific challenges or opportunities unique to the area. This local knowledge can streamline appraisals and underwriting, making the process smoother for buyers. Gathering all necessary financial documents, understanding your credit score, and determining an affordable down payment are foundational steps regardless of location, but local insights can provide an invaluable edge.

Local Financial Resources and Community Support

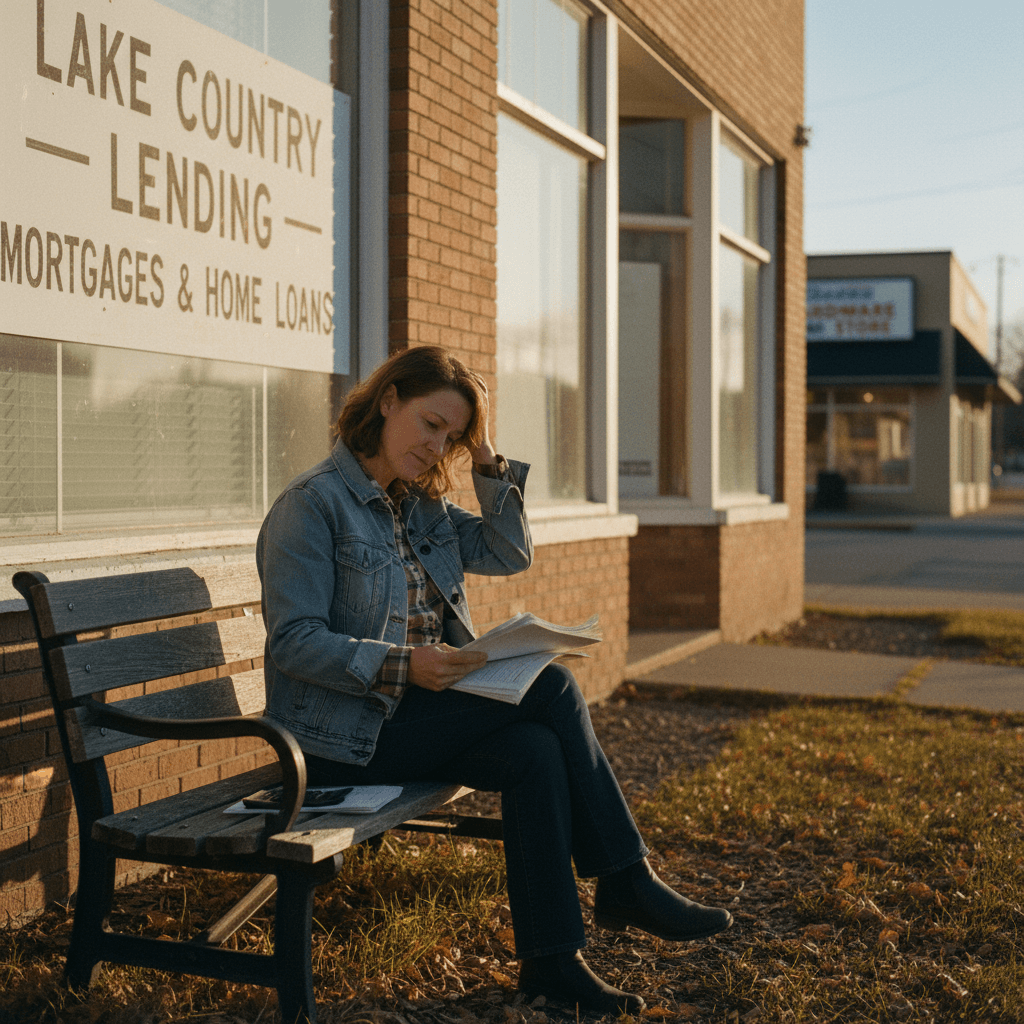

For those looking to finance a home in Vergas, tapping into local financial institutions and community resources can provide significant advantages. These entities are often deeply invested in the economic health of the area and can offer personalized services and insights that larger, more distant institutions might not provide.

Connecting with Vergas Financial Institutions

Engaging with local banks and credit unions is often the most direct route to understanding financing options tailored to the Vergas market. Institutions like Vergas State Bank are pillars of the community, offering a range of mortgage products and often possessing an intimate knowledge of local real estate trends and borrower needs. They can provide competitive rates, flexible terms, and invaluable advice that comes from years of serving the Vergas community. These local connections can be particularly beneficial for first-time homebuyers or those unfamiliar with the unique aspects of property ownership in the region.

The Importance of Local Expertise and Community Information

Beyond direct lending, local experts, including real estate agents and financial advisors who specialize in the Vergas area, are crucial resources. They can offer insights into fair market values, potential appreciation, and even the best neighborhoods suited to your lifestyle and budget. Furthermore, understanding the broader community through resources like the City of Vergas website can provide context on local taxes, services, and future development plans, all of which are important considerations for long-term homeownership. The strong community ties in Vergas mean that word-of-mouth and established local relationships often lead to the most accurate and helpful information for navigating your financial journey.

Conclusion

Purchasing a home in Vergas, MN, is an exciting prospect, offering a blend of natural beauty and small-town charm. By staying informed about current mortgage rates, understanding the local financial landscape, and leveraging the expertise of Vergas's community financial institutions and local professionals, you can confidently navigate the financing process. A well-informed approach ensures that your journey to homeownership in this beautiful Minnesota community is as smooth and successful as possible.

Frequently Asked Questions

What are the typical down payment requirements for homes in Vergas, MN?

Down payment requirements in Vergas, MN, vary depending on the loan type. Conventional loans typically require 5-20% down, while FHA loans can be as low as 3.5%. VA and USDA loans, often applicable in rural areas like Vergas, may require no down payment for eligible borrowers. Your specific requirements will depend on your credit score, debt-to-income ratio, and the lender's criteria.

How can local Vergas financial institutions help with my mortgage?

Local Vergas financial institutions, such as Vergas State Bank, often have an in-depth understanding of the local housing market, property values, and community-specific nuances. They can offer personalized service, competitive rates, and insights that larger, national banks might miss. Their familiarity with the area can streamline the appraisal and underwriting process, providing a smoother experience for local homebuyers.

Are there specific loan programs for rural properties in Vergas, MN?

Yes, Vergas, MN, as a rural community, may qualify for specific loan programs designed to assist buyers in such areas. The USDA Rural Development Loan program is a prominent example, offering 100% financing for eligible properties and borrowers in designated rural areas. It's advisable to check with local lenders to see if the property you're interested in qualifies for this or similar programs.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.